The federal government has repeatedly enacted rules and regulations designed to ensure that the mortgage market is fair for all borrowers. What notions of fairness do these rules and regulations correspond to? Have they made a difference? Is the mortgage market fairer today than it once was?

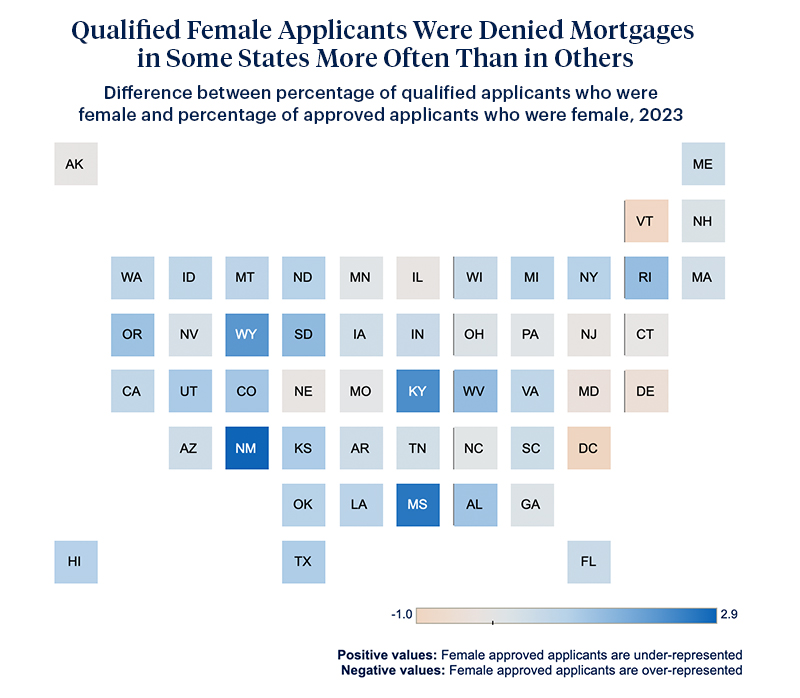

To answer these questions, we need to define “fairness” in statistical terms, but as it turns out, no one statistical measure of fairness sums up the complexity of this market. That’s why Philadelphia Fed machine learning senior economist Simon Freyaldenhoven, machine learning analyst Ryan Kobler, and senior economic advisor and machine learning economist Minchul Shin joined forces with Hadi Elzayn (currently a nonresident affiliate with Stanford RegLab) to create the Philadelphia Fed’s newest product, the Mortgage Fairness Explorer, which allows users to visualize fairness trends in the U.S. mortgage market by state, year, demographic group, and any of six competing and widely used measures of fairness. These six measures “lead to markedly different conclusions,” they write in their associated working paper. “By considering a wide range of fairness definitions,” they add on the product’s web page, “the explorer offers a comprehensive view of fairness in this market.” One of these fairness measures corresponds to the idea that the populations of qualified and approved applicants should be similar. For example, we can measure, state by state and year by year, the difference between the percentage of qualified applicants who are, say, female, and the percentage of approved applicants who are female. However, this is just one definition of fairness — other measures may diverge. There is no “smoking gun” proving that a market is fair or unfair, but by combining all six fairness definitions, the Mortgage Fairness Explorer enables us to acquire a more nuanced understanding of how we measure and regulate fairness, both in the mortgage market and more generally.

Learn More: Mortgage Fairness Explorer

Email: simon.freyaldenhoven@phil.frb.org

This article appeared in the First Quarter 2025 issue of Economic Insights. Download and read the full issue.