Article

Celebrating 80 Years of Community Bank Relationships

Community banks are crucial to local and national economies. It’s one reason why the Philadelphia Fed's longtime Field Meeting Series plays a key role in our outreach to communities across the Third District.

Discover Our District

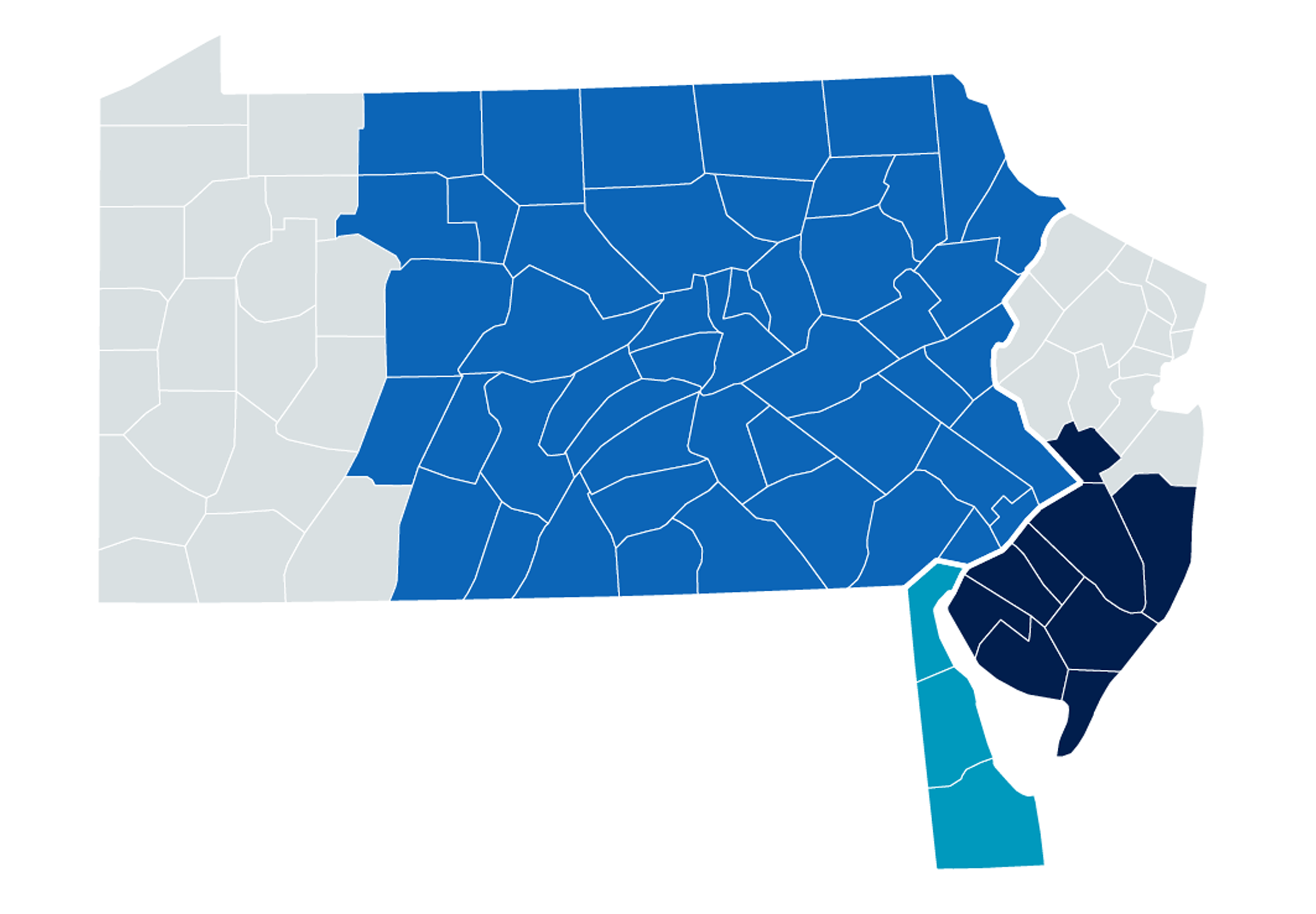

The Federal Reserve Bank of Philadelphia serves the Third District, which covers Delaware, southern New Jersey, and eastern and central Pennsylvania. The District’s economy is driven by a range of industries, including utilities, “eds and meds,” tourism, and agriculture. We celebrate the rich history of our region and work to support a strong economy for the people and communities who call the Third District home.

Learn More

Article

Fintech Conference Explores Innovations, Regulation, and the Future of Finance

The Philadelphia Fed’s Ninth Annual Fintech Conference took place on November 12 and 13. This conference series helps lead the conversation on what financial innovations mean for the future.

About Us

Sign up to receive our emails. Get the topics, newsletters, or data releases you want delivered right to your inbox.

Aruoba-Diebold-Scotti Business Conditions Index

11 Dec ’25

An index designed to track real business conditions at high observation frequency

Do Anchor Institutions Support Regional Economic Resiliency? Evidence from Penn State University

Universities and hospitals, as anchor institutions, significantly contribute to local economies by providing jobs and services. But what happens in downturns? This study analyzes the economic performance of State College, PA, during three recessions.

Speech

Economic Outlook

Philadelphia Fed President and CEO Anna Paulson shared her economic outlook at the 80th Annual Field Meeting Capstone.