Introduction

As of mid-April, the U.S. economy had been largely shut down to stem the spread of COVID-19. In just four weeks, a record 22 million American workers have filed claims for unemployment benefits. Small businesses have been hit even harder by the social distancing measures and mandatory business shutdowns adopted in response to COVID-19. As governments are increasing assistance to affected small businesses and planning to reopen, more research is necessary to understand which small businesses and workers are most vulnerable to help deploy assistance programs more efficiently and more equitably.

This brief focuses on two major channels through which COVID-19 has impacted small businesses in the short term. First, social distancing measures have hit small businesses in certain industries harder than others by radically reducing demand for their services. As almost all Americans are required to stay at home, industries that require direct physical proximity with customers or coworkers are faced with plummeting productivity, sales, and revenue. Second, almost all state governments have explicitly required nonessential businesses to close their physical locations to suppress the spread of COVID-19. Thus, small businesses identified as nonessential lose almost all their revenue, given many of them find it difficult or simply cannot operate remotely. These two intertwined channels have a concentrated effect on certain sectors more so than others. If businesses in these industries are forced to close permanently, this will inevitably slow the economic recovery and lead to a jobs crisis.

By compiling a list of industries directly impacted by COVID-19, we estimate that:

- at least 32 percent of all small businesses (firms with fewer than 500 employees), or 1.9 million firms, face serious financial challenges during the shutdown.

- at least 20 million employees in small businesses directly affected by the pandemic are at risk of being dislocated — either being furloughed, becoming unemployed, or being forced to seek employment in more secure sectors.

- the mandatory nonessential business shutdowns that vary significantly across states could impact over half of all small businesses.

- small business workers who are already vulnerable in the job market are likely to be hit harder, such as younger, less educated, and nonwhite workers.

What Small Businesses Are Most Likely to Be Struggling with Business Closures?

Small Businesses in the Hardest-Hit Industries

We identified six hardest-hit industries — sectors considered the most vulnerable to the policy responses to COVID-19 — by compiling data from two sources. The first data source is a list of industries, identified by our colleagues Keith Wardrip and Anna Tranfaglia, in which a significant share of workers (over 40 percent) are in occupations that require close physical proximity to their customers or coworkers.1 The second data set comes from a research note by Moody’s Analytics,2 which identified a set of industries that are “most at risk” because of responses to the COVID-19 pandemic. As Table 1 shows, industries identified by these two approaches have significant overlap but also some apparent differences. Most industries from these two sources, except construction and mining,3 are considered among the hardest-hit industries in this study.

Table 1. Hardest-Hit Industries by COVID-19

| Industry | NAICS Code |

|---|---|

| Retail trade (except grocery and pharmacy)a | 44 and 45 (excluding 4451, 4452, 4461) |

| Transportationb | 48 |

| Employment servicesb | 5613 |

| Travel arrangementsb | 5615 |

| Arts, entertainment, and recreationa,b | 71 |

| Accommodation and food servicesa,b | 72 |

| Note: a indicated industries with larger shares of workers with high level of physical proximity by Wardrip and Tranfaglia (2020); b indicates industries categorized as most at risk in a research note by Moody’s Analytics (2020). | |

By linking these hardest-hit industries to the most recent small business data from 2017,4 we identified about 23 percent of small businesses (1.4 million firms) and 28 percent of small business employees (about 17 million) that are likely most affected by the pandemic. In the Third Federal Reserve District states (Pennsylvania, New Jersey, and Delaware), there are about 120,000 small businesses and over 1.1 million small business employees in these hardest-hit industries.

The Aggregate Effect

In addition to the industries hit hardest by the pandemic, small businesses in other sectors could suffer from the effects of COVID-19 as a consequence of government-mandated business shutdowns. As of mid-April, almost all state governments had mandated the closure of physical locations of nonessential businesses to suppress the spread of the virus.5 Businesses that fail to comply risk citations, fines, or license suspensions. While the definition varies from state to state, recreational businesses like museums, movie theaters, gyms, casinos, and motion picture and video production, as well as certain retailers like furniture stores, florists, and shopping malls tend to fall in the nonessential category. But in some states, nonessential businesses cover many more industries, such as construction, certain kinds of manufacturing, and many service sector businesses. As an illustration, we estimate the aggregate impact of COVID-19 on small businesses based on the following assumptions:

- All states have mandated the same level of shutdown of nonessential businesses.6

- The baseline scenario assumes a moderate level of business shutdown, proxied by the definition in Delaware (the moderate shutdown scenario).7

- The scenario with a broad level of business shutdown is proxied by the definition of non-life-sustaining businesses in Pennsylvania (the broader shutdown scenario).8

- Only small businesses in hardest-hit industries or nonessential industries (except those with telecommute capabilities to allow employees to work from home)9 are affected.

- The exercise assumes no relief programs to assist small businesses.

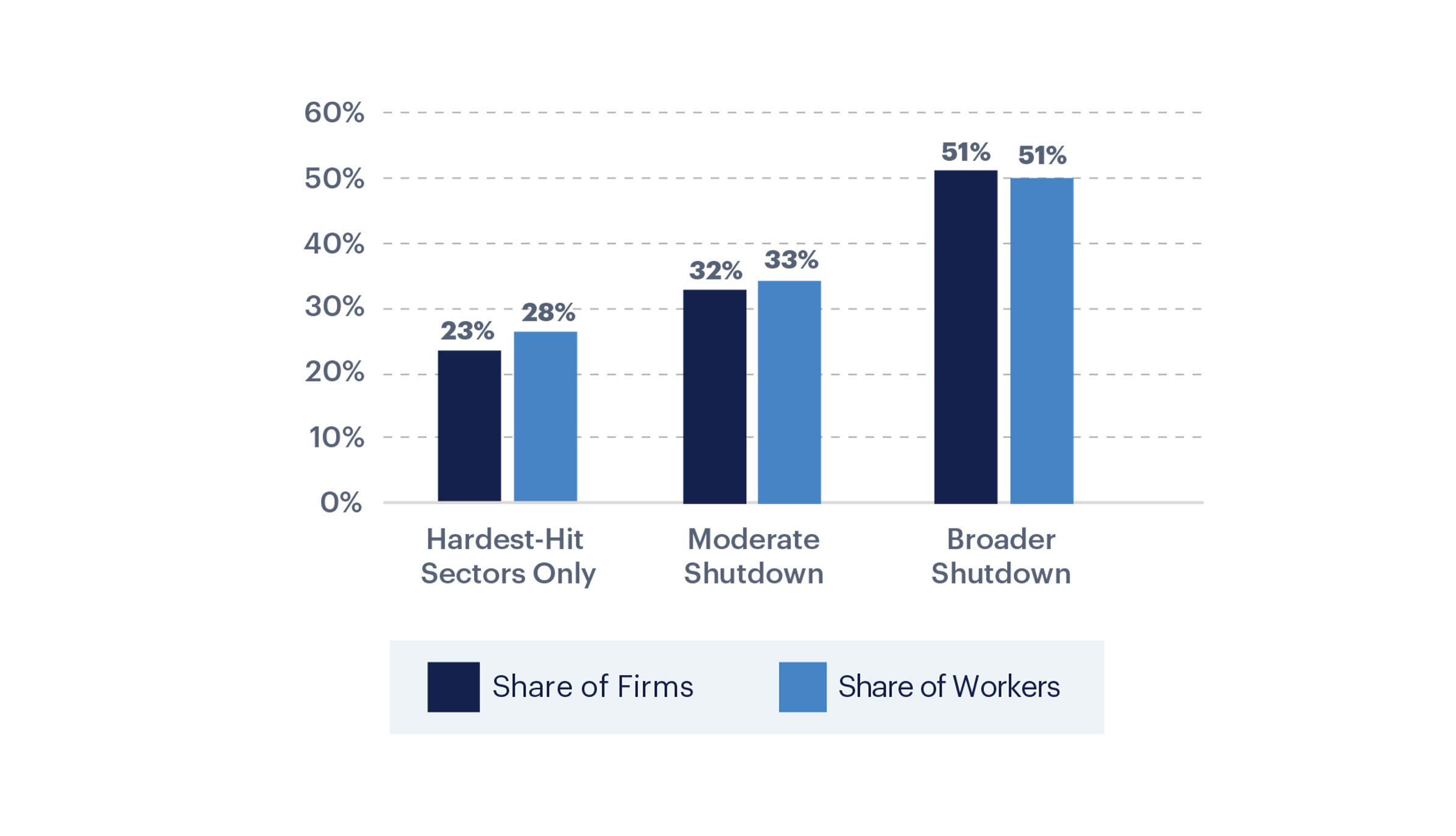

Nationally, we estimate that about one-third (32 percent) of small businesses, or 1.9 million firms in total, have an immediate risk of being closed in the moderate shutdown scenario (Figure 1). Under the baseline scenario, over 20 million employees (or 33 percent of all small business employees) are likely to be impacted and have a high risk of becoming jobless unless they receive timely assistance. The results suggest that the moderate shutdown does not add much to the economic harm to small businesses outside the industries already hit hardest by the COVID-19 pandemic — only an additional 9 percent of small businesses and an additional 5 percent of small business workers are likely affected by the shutdowns.

Figure 1. Share of At-Risk Small Businesses and Workers (U.S.)

In practice, business shutdowns are often much broader because states may have ordered more businesses than those required in the moderate shutdown scenario to close. Moreover, small businesses outside the shutdown lists often choose to close voluntarily in response to COVID-19. Had all states mandated a broader business shutdown, over half of all small businesses and small businesses employees (51 percent or 3.1 million small businesses, and 51 percent or 31 million small business employees) would have been significantly impacted. The actual magnitude of affected small businesses is probably somewhere between the moderate shutdown estimate (the lower bound) and the broader shutdown estimate (the upper bound), because some states pursued the moderate approach, while others, like Pennsylvania and those in areas that were hit hard by COVID-19, have adopted the broader approach.

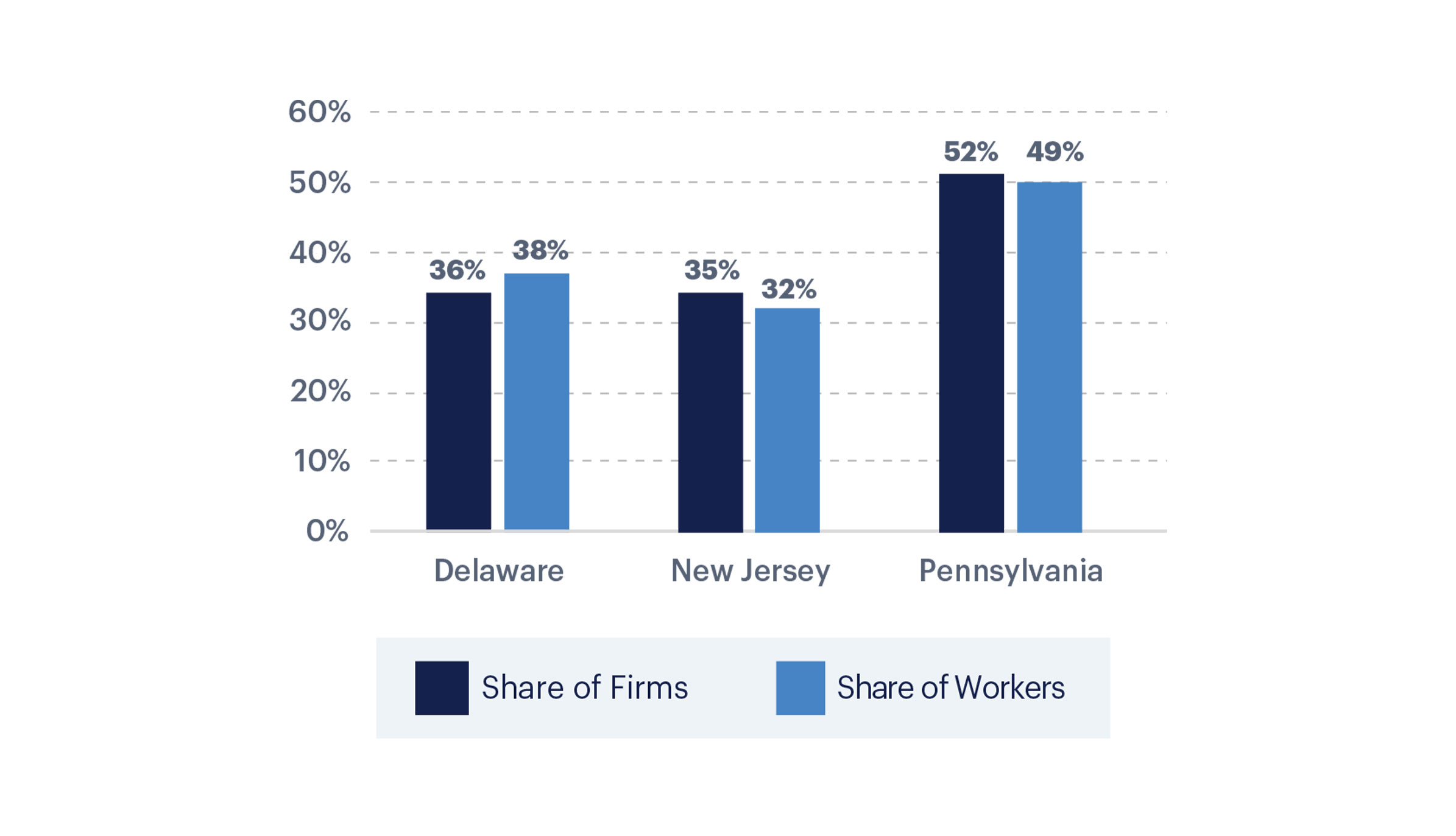

Figure 2. Share of At-Risk Small Businesses and Workers (Third District States)

In the Third District states, a total of 190,000 small businesses (44 percent) and over 1.8 million small business employees (42 percent) are likely to be affected (Figure 2). In Delaware and New Jersey, about one-third of all small businesses are impacted in the baseline scenario, while in Pennsylvania, approximately half of small businesses and small business workers (52 percent of small businesses and 49 percent of workers) are affected, primarily because the state adopted a broader business shutdown.

Of course, the goal of this exercise is to give practitioners and policymakers a sense of the magnitude of the short-term impact on small businesses, instead of attempting to provide a precise number of small business that will eventually close. The scale of the problem is unprecedented, even when we adjust some of our assumptions, and we believe we are providing a relatively conservative estimation.10

Which Small Businesses and Small Business Employees Are Disproportionately Affected?

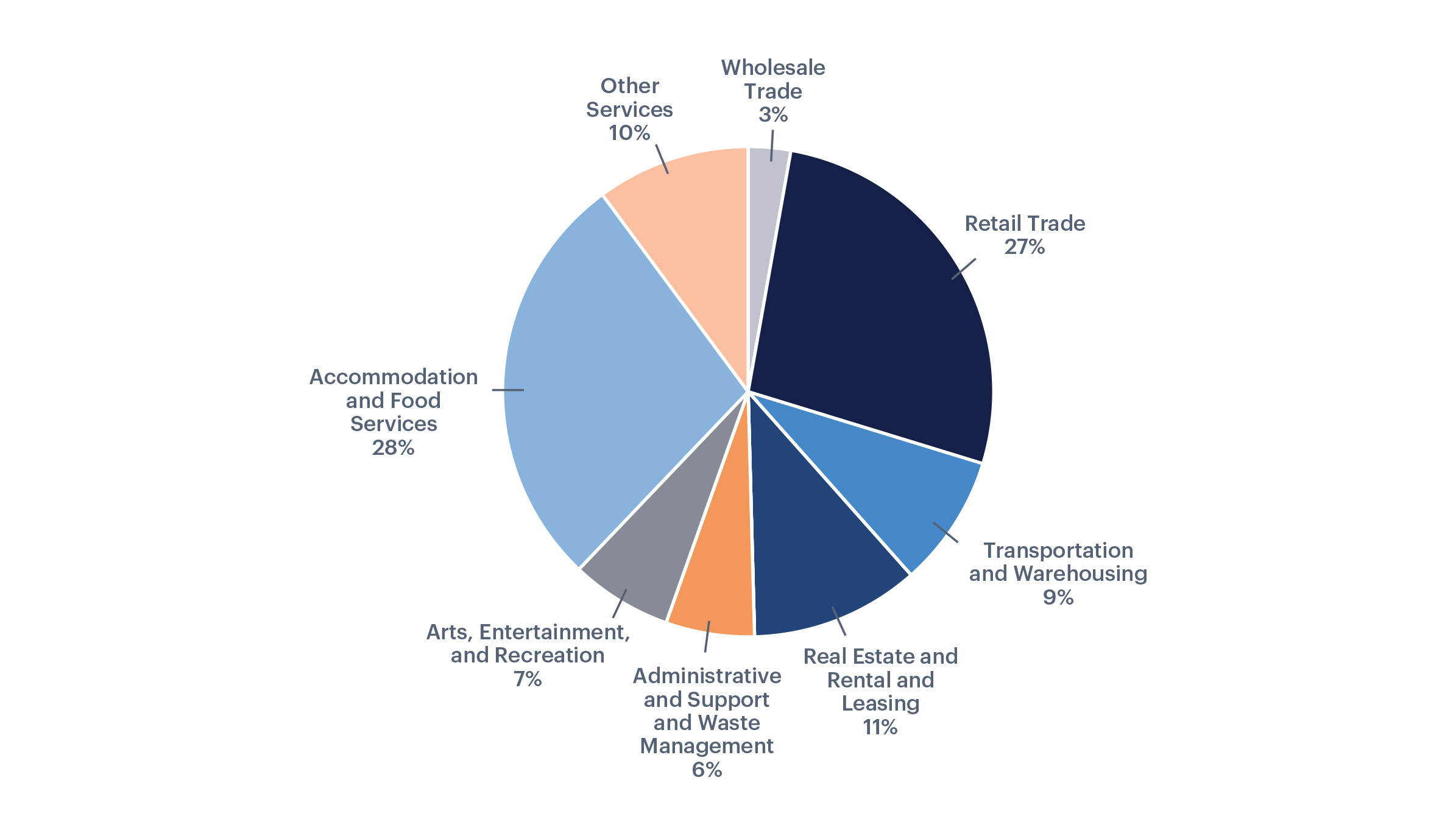

Figure 3 illustrates the composition of the industries that are likely to be affected by falling consumer demand or the mandated closure of nonessential businesses. In the moderate shutdown scenario, small businesses in retail and accommodation and food services account for over half of all affected businesses (27 percent and 28 percent, respectively), followed by real estate and rental and leasing (11 percent); other services (10 percent); transportation and warehousing (9 percent); arts, entertainment, and recreation (7 percent); and others. In this scenario, with a few exceptions, the hardest-hit industries still account for the vast majority of the affected small businesses.

Figure 3. Small Businesses Affected by Moderate Shutdown by Industry (U.S.)

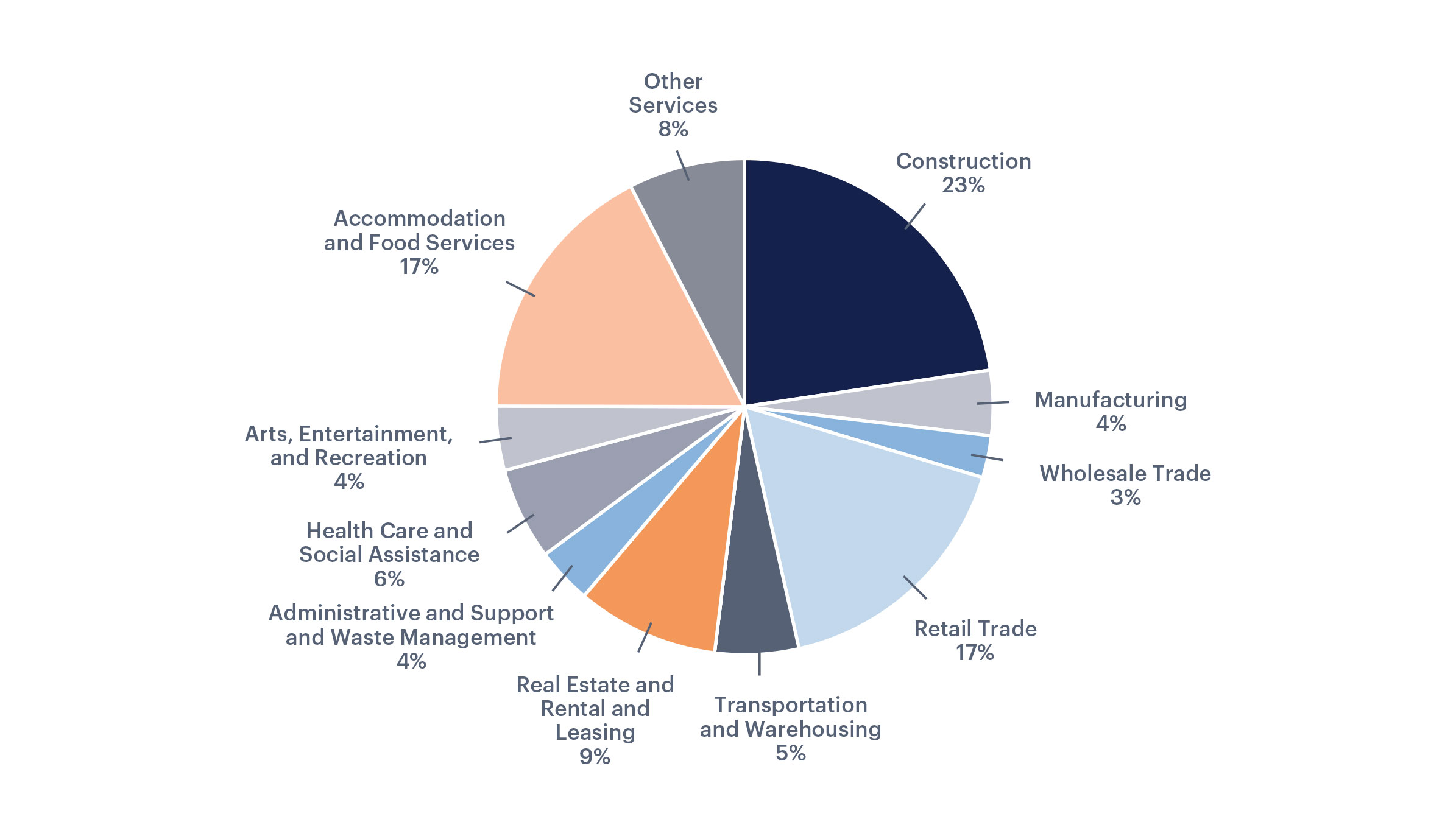

Figure 4. Small Businesses Affected by Broader Shutdown by Industry (U.S.)

In the broader shutdown scenario, the industry composition of affected sectors also changes radically, while the share of affected businesses increases from 32 percent to 51 percent. The broader shutdown defines additional businesses as nonessential, such as liquor stores, electronics and appliance stores, daycare centers, and others, in the sectors already partly affected by the moderate shutdown. Furthermore, construction is affected by the broader shutdown and accounts for the largest share (23 percent) of affected businesses (Figure 4). Manufacturing (4 percent) and health care and social assistance (6 percent) are affected as well. Obviously, the broader mandatory closure has a direct and more significant impact on local economies, disrupting the operation of more small businesses. Figure 5 provides a comparison of the share of impacted small business employment by industry under different levels of mandatory shutdowns.

Figure 5. Share of Small Business Employment Affected by Mandatory Shutdown by NAICS Sector (U.S.)

At-Risk Small Business Workers by Demographic Groups

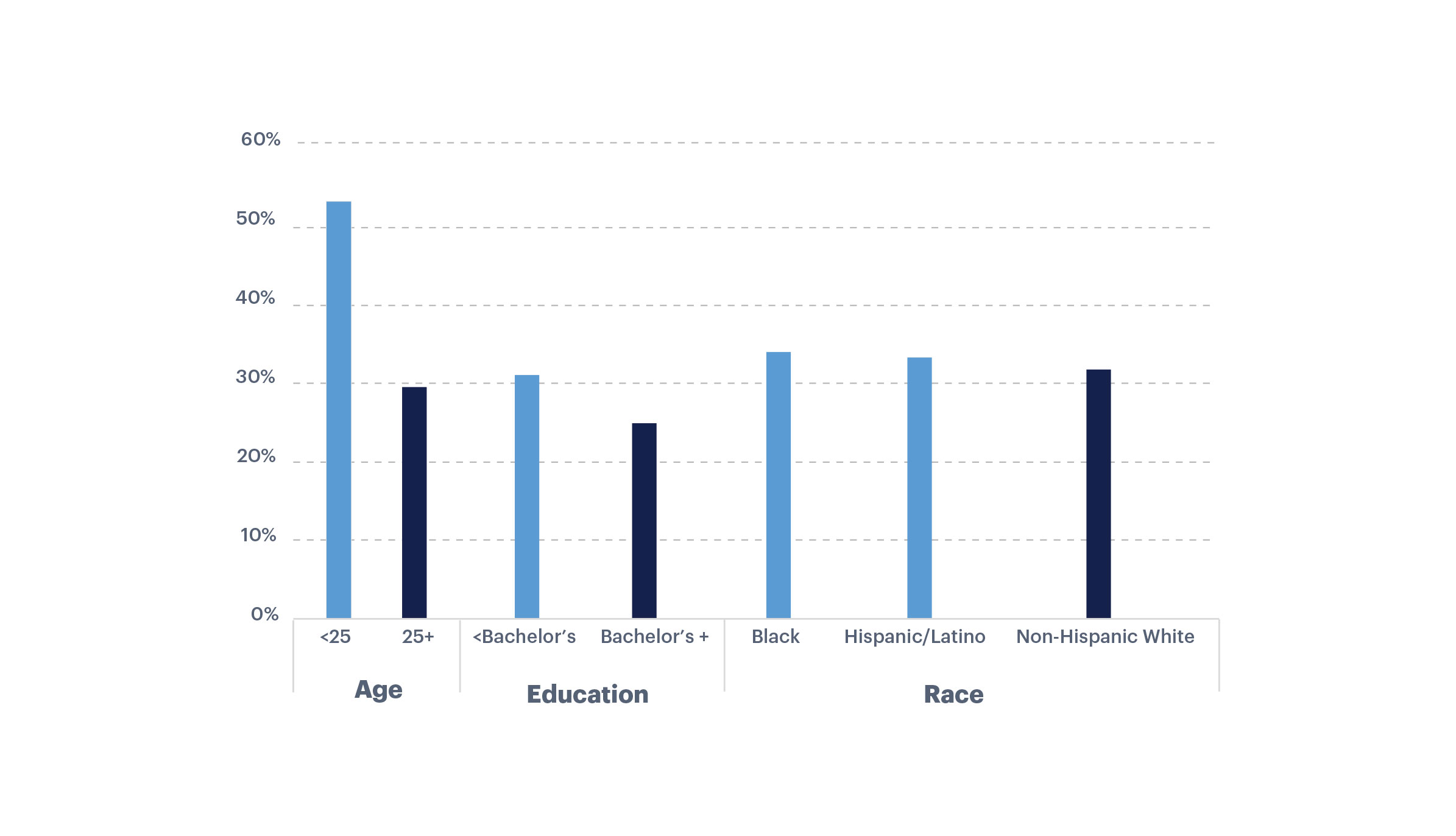

Small businesses in many of the at-risk industries such as retail, food service, and arts/entertainment traditionally provide entry-level jobs for younger and people with less formal education. As these industries are affected by the pandemic, we found that vulnerable small business employees, who are primarily younger, less educated, and nonwhite workers, are more likely to be at risk from the economic fallout from COVID-19 (Figure 6). Younger small business workers (under age 25) are the group most affected by business shutdowns. At the national level, 53 percent of younger small business workers are at risk, compared with just 30 percent of older workers (25 years old or older). A large difference can be found among groups with different educational attainment. Those without a bachelor’s degree are about 6 percentage points more likely to be at risk (31.1 percent) than workers who hold a bachelor’s degree (25.0 percent). In addition, nonwhite small business workers (black or Hispanic) have a slightly higher level of risk than non-Hispanic white (34.1 percent for black and 33.4 percent for Hispanic, versus 31.7 percent for non-Hispanic white) at the national level, in the moderate shutdown scenario.11

Figure 6. Share of Affected Small Business Employees by Demographic Groups (U.S.)

Implications and Takeaways

As state governments start to consider reopening local economies, the resilience of small businesses is crucial for the recovery of our economy after this crisis. That said, the transition out of the COVID-19 closures will take cross-sector support and collaboration at all levels. A variety of governmental relief programs, both local and federal, are directing aid to small businesses that have been impacted by these business closures. There are concerns that many small businesses lack the connection to mainstream financial institutions and often lack the technical skills to apply for these programs. In order to access newly emerging lending resources, many small businesses will require targeted technical assistance to guide them through the disaster funding process and a coordinated effort among federal, state, and local resources to support struggling firms. Quick and coordinated technical assistance will be a key factor in saving at-risk firms.

The 2020 Small Business Credit Survey shows that 86 percent of small businesses are not able to withstand a financial shock of two months lost revenue.12 Likewise, the median small business has only 27 days’ worth of cash buffer in reserve, with restaurants, retail, and personal services having even fewer days’ worth of cash buffer.13 These businesses, many of which are identified as at risk in this study, are likely to face immediate liquidity challenges created by COVID-19 shutdowns. Given the greater financial challenges accompanying the COVID-19 crisis, they need to identify and use all forms of assistance available to them to achieve financial stability during and after the pandemic.

In the face of mounting financial challenges and great uncertainty about reopening, small businesses may have had no choice but to let workers go. With nearly 22 million workers becoming jobless over the four weeks since the start of large-scale shutdowns, we are concerned whether many of the 20 million at-risk small business workers we identified have become unemployed or will lose their jobs very soon, given the trajectory of the current job crisis. As we pursue an equitable recovery to the COVID-19 crisis, several questions emerge that are relevant to both the design and implementation of small business assistance programs:

- Does the current economic reality indicate that the support provided by existing relief programs is inadequate in addressing the financial challenges of affected small business owners?

- If so, how should we provide additional, better-targeted assistance to prevent vulnerable small businesses from failure?

- And as layoffs and furloughs increase, how can we refocus to assist affected workers, in addition to assisting affected businesses?

- What are the prospects for affected small businesses and workers if parts of the economy reopen soon?

Identifying the answers to these questions takes the acknowledgment of which firms and workers are most vulnerable, as we have tried to do in this brief.

What Can You Do?

Read: Weekly Business Outlook Survey on the COVID-19 Outbreak, Which Workers Will Be Most Impacted?, Can Small Firms Weather the Economic Effects of COVID-19?

Access Other Resources: CDC Guidance for Employers, SBA Coronavirus (COVID-19): Small Business Guidance & Loan Resources, U.S. Chamber of Commerce, America’s Small Business Development Centers, Council of State Chambers, Philadelphia COVID-19 Small Business Relief Fund, Pennsylvania Department of Community & Economic Development, Pennsylvania Department of Health Information for Businesses, Pennsylvania Chamber of Business and Industry, New Jersey Government Resources, New Jersey Chamber of Commerce, Delaware Division of Small Businesses, Delaware State Chamber of Commerce, Philanthropy Delaware, IRS Economic Impact Payments Q&A

Reach Out: How is your community supporting the hardest hit small businesses and their workers as the nonessential business shutdown continues? Share with us online: #JobEquityCOVID and/or #WealthEquityCOVID

- These industries include retail trade, arts/entertainment and recreation, accommodation and food services, and construction. The level of physical proximity is estimated based on the occupation’s tasks in close physical proximity to other people from O*NET (see more details at www.philadelphiafed.org/covid-19/covid-19-equity-in-recovery/which-workers-will-be-most-impacted).

- The Moody’s Analytics report is available at www.economy.com/economicview/analysis/378644/COVID19-A-Fiscal-Stimulus-Plan.

- The mining industry was hit hard by the collapse of oil prices that happened roughly at the same time as the COVID-19 outbreak in the U.S., instead of the COVID-19 pandemic itself. Construction, although with a high level of occupational contact intensity, is considered essential by many states.

- The 2017 Statistics of U.S. Businesses Annual Data Tables by Establishment Industry is available at www.census.gov/data/tables/2017/econ/susb/2017-susb-annual.html.

- An ABC News story suggests at least 46 states and Washington, D.C. have enacted policies to close nonessential businesses as of early April 2020, available at abcnews.go.com/Health/states-shut-essential-businesses-map/story?id=69770806. See another summary of essential business defined by different state and local governments at www.businessinsider.com/what-is-a-nonessential-business-essential-business-coronavirus-2020-3.

- Most states identify essential or nonessential businesses by industry, while other states, like California, identify essential business by using occupations performing essential infrastructure jobs, as defined by the Department of Homeland Security, a list of which is available at www.cisa.gov/publication/guidance-essential-critical-infrastructure-workforce.

- Delaware specifies a relatively narrow definition of nonessential businesses, which should be similar to or looser than the practice in most states, based on our evaluation of their definitions and essential businesses defined by different state and local governments, as summarized at www.businessinsider.com/what-is-a-nonessential-business-essential-business-coronavirus-2020-3. A full list of essential and nonessential businesses in Delaware is available at coronavirus.delaware.gov/wp-content/uploads/sites/177/2020/03/Delaware-list-of-essential-and-nonessential-businesses-March-24-2020.pdf.

- The list of life-sustaining businesses in Pennsylvania is available at www.scribd.com/document/452553026/UPDATED-4-00pm-April-1-2020-Industry-Operation-Guidance.

- Employees in the following sectors are assumed to have telecommute capabilities with limited disruption, so store closures are assumed to have no impact on their business: information, professional, scientific, and technical services; finance and insurance; management of companies and enterprises; and educational services. These are the sectors with the largest shares of workers who can work from home by industry, as suggested by the census data available at www.bls.gov/news.release/flex2.t01.htm.

- While not all businesses in the hardest-hit industries we identified will close, we are afraid most of them by themselves do not have the resources to handle a financial shock at this scale. Furthermore, we estimate that almost 4.7 million additional small business employees are working in occupations requiring a high level of contact intensity but are not in our list of at-risk industries. Not including these at-risk workers is likely to lead to an underestimation of the affected small business employees.

- The pattern for younger and less educated workers is similar in the broader shutdown scenario, while non-Hispanic white workers are more likely to be affected because they are overly represented in the construction and manufacturing firms that are ordered to close in this scenario.

- When experiencing a two-month loss in revenue, 86 percent of small businesses would need to apply mitigation measures to remain open, such as using the owner’s personal funds, taking out more debt, or reducing staff salaries. See the report at www.fedsmallbusiness.org/survey/2020/report-on-employer-firms.

- See more details in the JP Morgan study, Cash is King: Flows, Balances, and Buffer Days, available at www.jpmorganchase.com/corporate/institute/document/jpmc-institute-small-business-report.pdf.